Isaac Olayiwola, popularly known as Layi Wasabi is a fast-rising Nigerian comedian/skit-maker currently cracking the ribs of his audience (mainly Nigerian) on various digital platforms . He gave us an insight into his life, finances, and what he plans to do with his incredible talent.

What was growing up like?

I had a pretty basic childhood. I didn’t have so many friends – it was just my mum and my younger brother and me. I lost my dad when I was about two years old. Oh! one more thing; as a child, I got into trouble a lot (laughs). It had to do with what I was always saying.

Why am I not surprised?

(laughs) I got in trouble in school especially, because of the jokes I always told. Not that they were inappropriate, but it was more like when the subject of the joke hears the joke, they wouldn’t find it funny.

This was in secondary school?

Yeah, I went to Redeemer’s International Academy, Ifewara, then I attended Bowen University where I studied Law.

Did you envisage that you would get this kind of popularity on social media?

Not really. I started doing skit-making for the fun of it, although, I always had a major interest in comedy for the longest time. In secondary school, I made a few clips with some of my friends in the classroom. We recorded funny videos for people to see and that was it. But in my final year at the university, I felt like I could get started with comedy. The platform (social media) was already available, so I took my time to understand the TikTok algorithm. Then I started making videos on TikTok for the fun of it and that was it. Initially, I felt that the humor that appealed to me might not appeal to others, but I started getting engagements. It was crazy mehn.

When was this?

I started posting on TikTok late last year (October 2021) and the first viral video I had was in December/January. So basically, two months in. Since then, I’ve been getting all kinds of engagements, even when I had less than 1000 followers.

Oh, nice! What does your mum think about it?

My mum is on-board now, although she didn’t buy the idea initially. I come from quite an educated family so my mum was about the educational path. She’s a fan of my work now (laughs)

Is there anyone in the industry who inspires you?

I’ll say Bovi. If I had to pick a comedian to understudy, it will be him. I love his approach to humor. He is super intelligent. For skit making, I admire Sydney Talker. I believe he set the tone for a lot of skits we see now. In terms of acting, it is Odunlade Adekola

Have you thought about the financial sustainability of the comedy path you want to tow?

Definitely! I know I might not have enough leveraging power now, but I will get there eventually. I’m still understanding the rules of the game, but I know I’m up to the task. Besides, there is a lot of money to be made in comedy.

Now that you have become a household name, we’re assuming you’ll be getting more paid gigs. Do you have any plans to save and invest part of it?

Oh sure! I save most of the money I make and use the rest to invest in my crafts and my brand.

Can you tell us more about that?

I believe I’ll do better if I spend more money on my craft. I’m talking in terms of costume, equipment, the movies I watch, and the books I read. All these things eventually count.

Do you have any stipulated money you save or invest regularly?

I don’t have a strict amount for that but I just try as much as possible to cut down any unnecessary expenses. Luckily for me, I don’t indulge in a lot of frivolous spending. Whatever money I get from gigs, I save it. That is of course after I take out production expenses and transport costs.

Have you ever invested before?

Absolutely!

Tell us about it!

My first investment/entrepreneurial adventure started with a shoe business I ran when I was in school. Unfortunately, it failed.

Oh wow!

Haha, yes oh, the funny thing is, I had fantastic marketing skills and a good customer base. Because I was in school, I was the middleman. The cobbler was was one of the best in Osogbo at the time. So what I did was take the order from my customers in school, and send them to him to make immediately. After he makes them, I pay him his fees, take my cut, and deliver the shoes. But he wasn’t efficient at all. I had a two-week delivery timeline but I told him I needed them in 5 days. However, he wouldn’t give me the shoes for two/three months. It was so embarrassing because it made me look fraudulent. I wanted to build a business based on integrity so I had to refund a certain percentage to the customers, and eventually closed down the business.

Will you go into the business again?

Shoe business? No oh. Maybe I’ll do something else. I did it because I liked shoes a lot at the time. But right now, I’m not as crazy as I was about shoes. I’ll still do some buying and selling in the future but I just don’t know what it’ll be.

Tell us about a major financial challenge you faced and how you dealt with it.

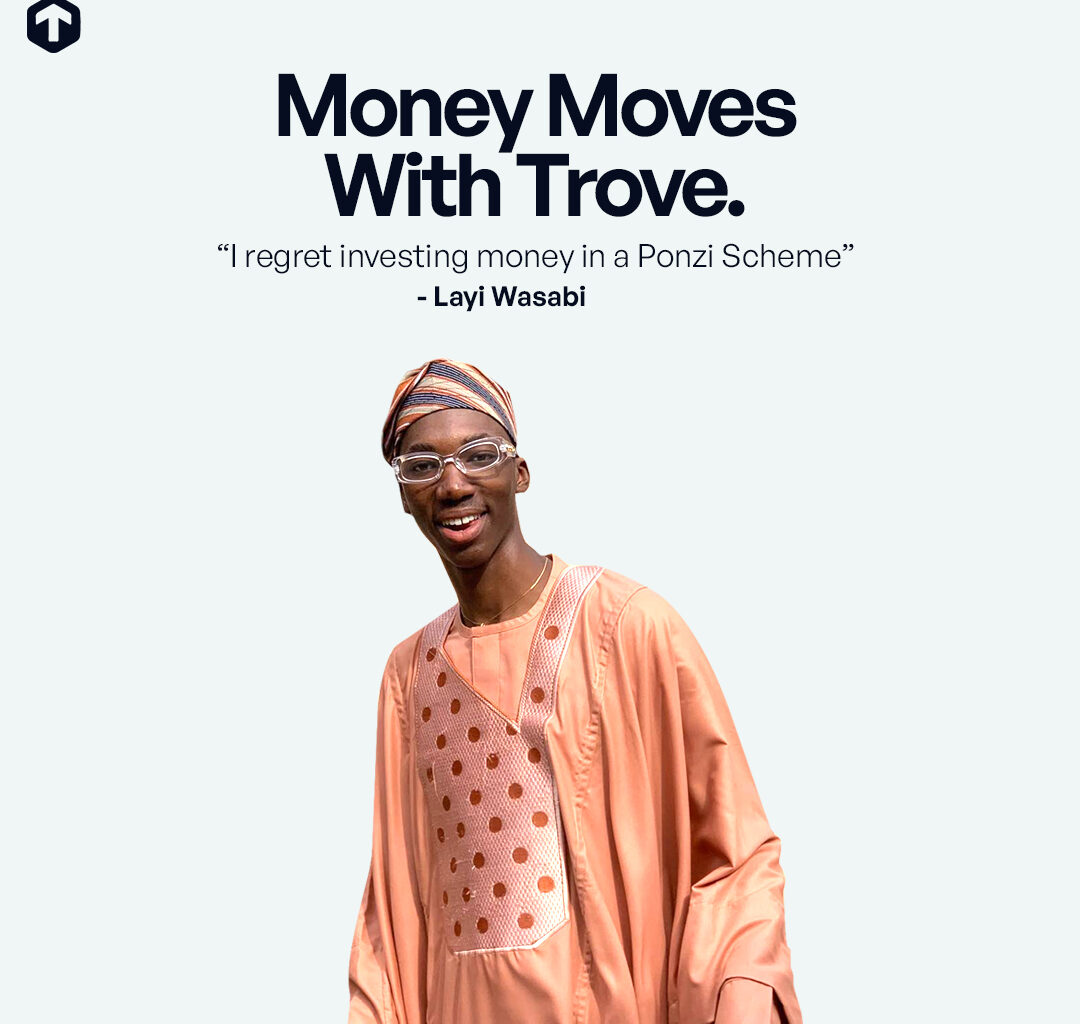

Hmmm… let me see. As much as possible, I try hard to not be broke. It has happened a few times but it didn’t last long. But there was one time I made a bad financial decision. I invested in a Ponzi Scheme in 2020 even though my mum warned me about it. I was under pressure from friends to do it. Funny thing is that a lot of people were making money from it so it didn’t seem like a Ponzi scheme initially. The company said they were investing our money in real estate, so it was not the regular type. I invested about N150,000. It was all I had and they didn’t give me a kobo back!

Wow!

My brother and I put our money together so the total was about N300,000. What they said was that we would get N550,000 after two months which did not seem ridiculous. Those people played their game well sha

So I’m guessing you will never invest in a Ponzi Scheme again…

Oh…NEVER. I’m wiser now!

So, what should we expect from Layi Wasabi?

Hmmm….in the next five years, expect to see a stand-up comedian killing it in everything he is doing!

Yass! We’re rooting for you!

Thank you so much.